There has been constant chatter about the need for banks to focus on the customer, improve customer experience and protect themselves from credit unions and non-bank competitors. I’ve been one of the people beating the drum on “being a better bank.” The Occupy Wall Street movement (where are those guys anyway?) did not distinguish between banks and “Wall Street” financial firms in expressing their discontent and agitators thought that “Bank Transfer Day” would really show banks the power of the consumer.

Then I saw Phillip Ryan’s recent post on Bank Innovation “The Race for Retail Deposits” and it made me say hmmmmmm – are the banks laughing all the way to the bank? According to the figures presented (I’ve shown a slice of the information for the top 10 below) the top 10 banks in terms of their percentage increase in deposits between 2011 and 2012 have increased their deposits on average by over 7% while decreasing their total number of accounts by 0.72%. If you expand this to the top 20 on the list, banks shed nearly 10% of accounts and increased deposits by 2.7%.

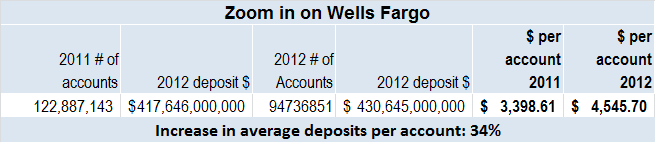

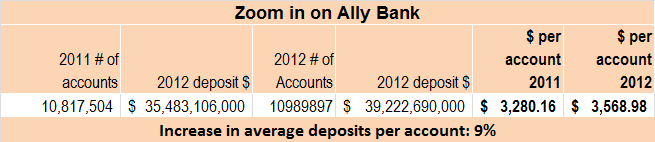

The most dramatic example is Wells Fargo which “lost” nearly 23% of clients from the previous year and still managed to increase deposits by over 3%. (I’ve included a slice of the information from the top 10 below.) If you take a closer look at the numbers you see that in dropping all of those accounts, Wells Fargo increased their average deposits per account by 34%. In contrast, Ally Bank, the “top ranked” bank on the list had the biggest percentage increase in deposits but only increased their average deposit per account by 9%. So boo-hoo, poor Wells Fargo just became way more profitable on their remaining accounts.

Who’s laughing now?

While many banks are rightly focused on more effective onboarding of new customers and cross-selling and up-selling and all that good shmarketing stuff, I’ve suspected for a while that banks were using those nifty analytics programs to do as much off-boarding as on-boarding.

So. . . credit unions are scooping up lots of accounts from banks – but are they only getting the ones that the banks don’t really want anyway? If so, it’s likely to cripple those credit unions as they are saddled with all the high expectation, low margin “bank switchers” and their big bank competition has even more profit to use to compete. We’ll see who gets the last laugh on this one. It’s probably not going to be the customers.