Over the past decade, assets held in Individual Retirement Accounts (IRAs) have increased steadily as a percentage of all U.S. retirement assets and now exceed those held in employer-sponsored retirement plans such as 401(k) plans and the increasingly elusive defined benefit plan. The increase in IRA assets is due in part to the transition the baby-boomer generation into retirement and the corresponding transition of their assets from corporate to private plans. However, the success of IRAs is also due in large part to very aggressive marketing by brokerages, mutual funds, annuity manufacturers and independent financial advisors.

IRA marketing over the past decade has ranged from highly educational materials and evaluation tools from the large financial firms to pretty sketchy sales programs sold to financial advisors. One “sales solution” touted to help advisors tap into the “trillion dollar IRA rollover market” boasts reliance on “IRA, CD Holders and Affluent Widows lists to generate leads in a niche market.” Even when the marketing tactics are intended to be fair and balanced, the comparisons necessary to make a retirement rollover decision are highly complex –even for seasoned financial advisors.

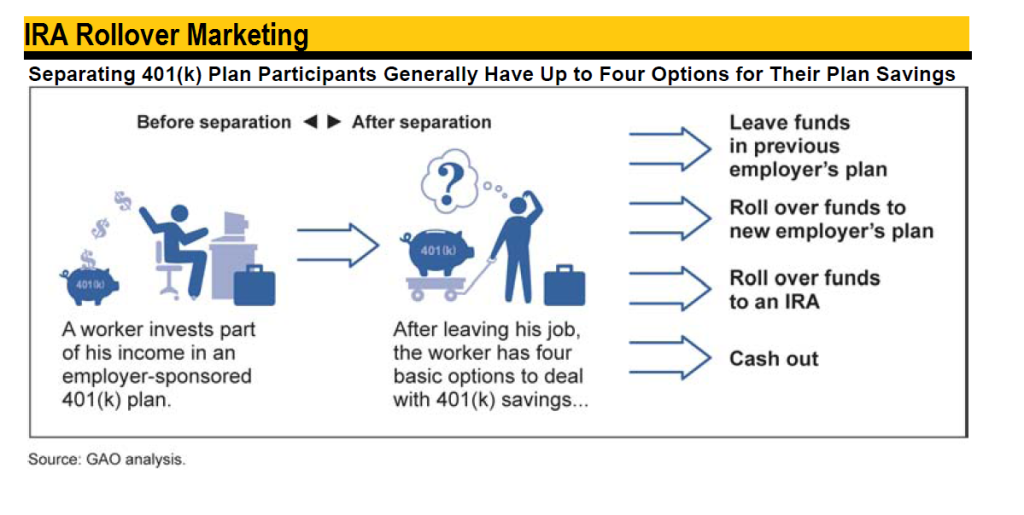

So, it’s not surprising that with IRAs potentially playing a “systemically important” roll in our country’s retirement savings that regulators would be giving IRA marketing some close scrutiny. The U.S. Government Accountability Office sent up the first flare with a March 2013 report urging the Department of Labor and the IRS to seek improvements in the rollover process for retirement plan participants. According to the report, the marketing of IRA rollovers to participants is sometimes embedded in the employer-sponsored retirement plan documents and pervasive in participant communications. Here is an excerpt from the study:

“The marketing of IRA products by providers is not limited to written materials but may also be pervasive in other interactions with participants. Participants can be steered toward IRA rollovers when receiving information from service providers, including via call centers. We were told by industry experts that

• participants think that they have received investment advice from their service providers that is solely in the participants’ best interest, even though they may not actually be receiving such advice;

• service providers use their websites and call centers, including making outbound calls to plan participants, as a means of marketing their firms’ retail IRA products and steering participants into them; and

• when taking a distribution participants may be steered first into a provider’s IRA product, and if they opt out or decline that rollover option, they are then directed to a portal sponsored by the same provider where participants can access other companies’ IRA platforms, for which the service provider receives some compensation if a participant chooses a company’s IRA through that portal.”

The SEC and FINRA have followed up on GAO recommendations with guidance on IRA marketing and the DOL is expected to follow suit shortly. FINRA’s Rule 2210 already requires that brokers’ communications with investors be fair and balanced, and provide a sound basis to evaluate the facts about securities and services. FINRA issued notice 13-45 in December 2013 to “remind firms of their responsibilities when (1) recommending a rollover or transfer of assets in an employer-sponsored retirement plan to an Individual Retirement Account (IRA) or (2) marketing IRAs and associated services.” FINRA goes on to say that reviewing firm practices in this area will be an examination priority for FINRA in 2014.

The aggressive marketing tactics used for the past decade or more to capture rollover assets will need a major overhaul in 2014 if financial firms want to stay on the right side of regulators. This will require an analysis and restructuring of all communications to both investors and financial advisors. IRA marketers need a new “fair and balanced” communications strategy or they will become victims of their past success.