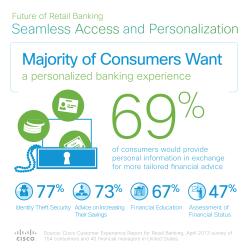

“Results show 69% of U.S. consumers would provide more private information in exchange for more personalized service, higher security against identity theft, and greater simplicity in managing their finances” according to an April 2013 release from Cisco Systems.

The findings in the study were based on a survey of 1,514 banking consumers across 10 different countries. So, if evenly distributed, that’s about 150 people per country representing 50 people in each age group segmented in the report. Does that sound like a quantitative sample to you?

The study also found that 56% of respondents would be willing to provide more personal information in order to simplify the management of finances. Given the plethora of research sources stating the trust issues the banking industry is facing these findings are intuitively suspect (which does not mean that they are not correct – I just don’t believe that they have been proven to be correct.)

For a much feistier analysis of why you should look carefully at who is publishing statistics and how they arrived at their conclusions read “Bank Customers Want A Seamless Experience (My Foot)” by Ron Shevlin of Snarketing 2.0. Ron engagingly captures the frustration that I have with poorly framed “research” and press release twaddle that purports to be scientific and is not. His take on the “seamless experience:”

For a much feistier analysis of why you should look carefully at who is publishing statistics and how they arrived at their conclusions read “Bank Customers Want A Seamless Experience (My Foot)” by Ron Shevlin of Snarketing 2.0. Ron engagingly captures the frustration that I have with poorly framed “research” and press release twaddle that purports to be scientific and is not. His take on the “seamless experience:”

“Consumers want things to work. Period. But if you must elaborate, they want things to work the way they expect those things to work, when they use them, and where they use them.

And consumers don’t want to have to think about any of it. They just want it to happen. If you really think about it, what they really want is for banks to be invisible.”

Ah, but banks don’t want to be invisible do they? I think this survey is less about how to make the typical banking experience seamless for the customer and more about how to allow banks (and more aptly, multi-product financial firms) to cross-sell products to banking customers. Of course Cisco would like to sell you some technology as well.

Beware marketing wolfs wearing science sheep’s clothing! While many of us might wish that the statements in this report were fact since it would make our jobs easier – resist the temptation to be herded in a particular direction by suspect research.