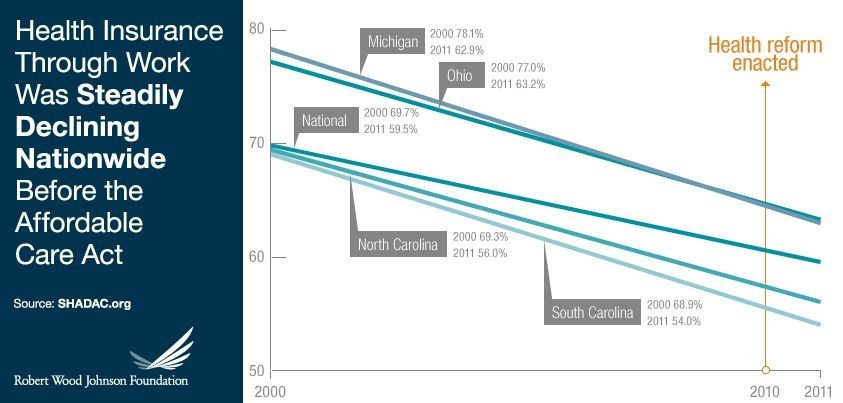

In April, the Robert Wood Johnson Foundation (RWJF) released a study highlighting declines in employer coverage across all states for which data was available. Only 56 percent of workers 18 and younger were covered by employer-sponsored health insurance (ESI), down from 76 percent in 2000. Coverage fell from 78 percent in 2000 to 65 percent in 2011 for workers age 26 to retirement. The loss of coverage was primarily attributed to loss of jobs or employees’ inability to pay matching portions of premiums as health insurance costs rose rather than a reduction in the number of companies offering ESI. Nationally, the percentage of private-sector firms offering ESI fell from 58.9 percent to 52.4 percent (although the percentage of workers eligible for coverage at firms that offered ESI held steady). Not surprisingly, the major change was at small firms where ESI fell from 67.7 percent to 56.3 percent while at large firms it remained essentially unchanged.

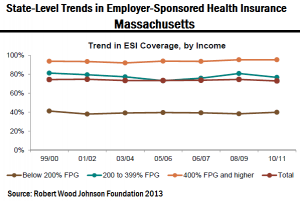

The Congressional Budget Office estimates, projects that full implementation of the ACA in 2014 will lead to a “small reduction in the number of people receiving employment-based health insurance.” However, research released this week by PwC’s Health Research Institute (HRI) shows that in the seven years since Massachusetts enacted its universal healthcare law, the number of people covered by insurance through the workplace actually increased, running counter to nationwide trends at the same time. Employer-sponsored insurance rose about 1 percentage point in Massachusetts while the national rate fell by 5.7 percentage points. The Massachusetts growth occurred in the midst of the recession and at a time when health insurance premiums in the state rose to the highest levels in the nation. (The RWJF study shows similar statistics for Massachusetts.)

“While each state and industry is different, Massachusetts’ experience may offer clues into how health organizations, the business community and individuals might react to elements of the Affordable Care Act set to take effect in 2014,” said Robert Valletta, PwC U.S. healthcare provider leader based in Boston. “Despite concern that the Affordable Care Act signals the end of employer-sponsored health coverage, our analysis of the Massachusetts experience paints a more complex picture.”

This report shows clearly that different segments of the population gain benefit from different aspects of the law and surrounding tax incentives to employers. According to HRI’s analysis, for Americans earning more than $45,960 for an individual, (scary statistic: that’s 400 percent over the federal poverty level) a combination of salary and health benefits obtained through an employer is likely to be a more efficient way to be compensated. It also found that due to federal tax exclusions, businesses can save thousands of dollars per employee by using that compensation strategy. Since the same is not true for those earning less than that number, insurance companies need to tailor their marketing to individuals, small businesses and larger entities carefully. Consumers may eventually be presented with more choices through their employers (if they have one) as well as through private exchanges. New tools will need to emerge to help consumers make sense of their options – including the option to forego health insurance and pay a penalty which is a scary reality for those too “wealthy” for government coverage – those perhaps only “100 percent over the poverty level.”

Implications for business communicators?

- Overhaul of employee benefits communications and E-to-E communications in general.

- Increased sophistication in health insurance marketing to employer and employee segments as well as improved wellness and retention communications to plan members.

- As state governments get involved in healthcare exchanges they will also have increased communications requirements.

As you start to see new plans and communications roll out – please let us know. Contact me to post examples using the contact form on the blog.