“Data Shows that Private Exchange Customers Overwhelmingly Select Different Levels of Benefits Than What Their Employers Had Offered Under Traditional Benefits Model”

This is the headline that opens the press release from Bloom Health regarding usage of their defined contribution private exchange platform and its impact on employee healthcare enrollment decision making. (See full release below)

Bloom goes on to claim that “Findings prove defined contribution private exchanges help employees select most appropriate insurance coverage for their personal needs, increase take-home pay.”

Is increasing take-home pay necessarily the most appropriate choice? The approach is clearly driving down costs for employers using the solution since 66% of employees choose coverage that reduces their premiums and thereby reduces the employers contribution as well – but, since this also lowers their coverage, will the majority of this group really be better off? Will they simply pay more out of pocket when they need care – or worse, forego care to avoid the cost?

Bloom offers a number of client case studies on their website which are very impressive from the  employer perspective, but there is no way to know if the decision support tools provided to employees are truly designed to match them with the “best” coverage for them or the coverage available at the lowest short-term cost. Bloom’s clients are employers and health insurance plans – not employees.

employer perspective, but there is no way to know if the decision support tools provided to employees are truly designed to match them with the “best” coverage for them or the coverage available at the lowest short-term cost. Bloom’s clients are employers and health insurance plans – not employees.

More choice is a good think – no argument there but I can’t see the findings that “prove” that employees are being guided to the most appropriate decision. If anyone out there has used the platform I’d love to hear from you.

MINNEAPOLIS, May 6, 2013 /PRNewswire/ — New data from employees using Bloom Health’s defined contribution private exchange shows how more choice and personalization through private exchanges results in many employees selecting benefit packages that are better aligned with their healthcare needs, risk tolerance, and financial flexibility.

In 2012, 66 percent of Bloom Health’s defined contribution private exchange customers opted to increase their take-home pay by choosing less rich coverage than they had prior to using the Bloom platform—when they had fewer choices and little, if any, decision support. During the same time, 11 percent of Bloom’s customers chose to invest in richer coverage than they previously had, and 23 percent chose benefit levels similar to what they already had.

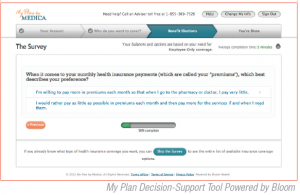

Bloom customers made their benefit decisions with the help of a robust decision-support tool, driven by a proprietary survey and recommendation engine.

“After more than three years in the industry, our experience and data shows that when you give people the ability to make personal decisions about the benefits that best fit their needs, there is a real opportunity for savings and increased take-home pay for employees,” said Bloom Health CEO Simeon Schindelman. In fact, premium contributions for employees using the Bloom solution are 20 percent below the national average.

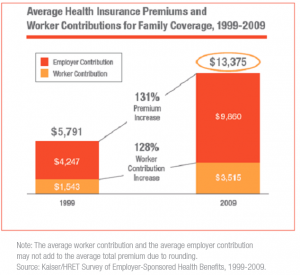

The employee savings are especially notable given that employees’ contributions to health insurance premiums have grown 167 percent since 2000 (Kaiser Employer Health Benefits Survey, 2012), compared to wage growth of just 39 percent (Bureau of Labor Statistics) over the same period.

“When we give employees choice and control over their wage vs. coverage tradeoff, our data clearly shows that they overwhelmingly choose to increase take-home pay. This could help reverse a decade-plus duration during which wages have been relatively stagnant, in large part due to the cost of health benefits,” Bloom’s Schindelman said.

For more information on Bloom Health’s defined contribution private exchange platform, go towww.gobloomhealth.com.